Unlike traditional bridging finance, Property Credit’s short-term bridging solutions allow you to not only move from one property to the next with ease, but overcome a whole host of common cash flow barriers. Using the equity in the property you’re selling, you can fund everything from advertising costs and pre-sale improvements, to a deposit for your next property.

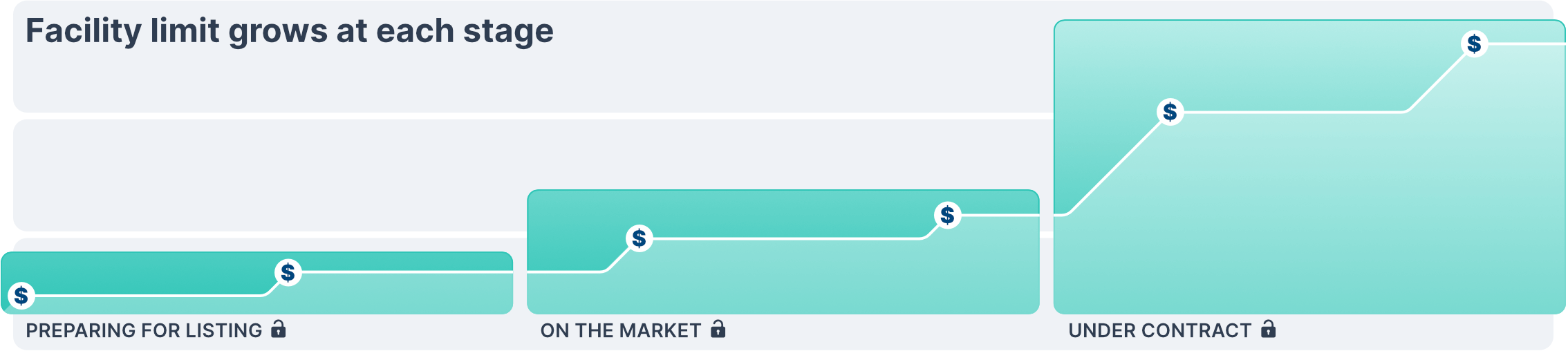

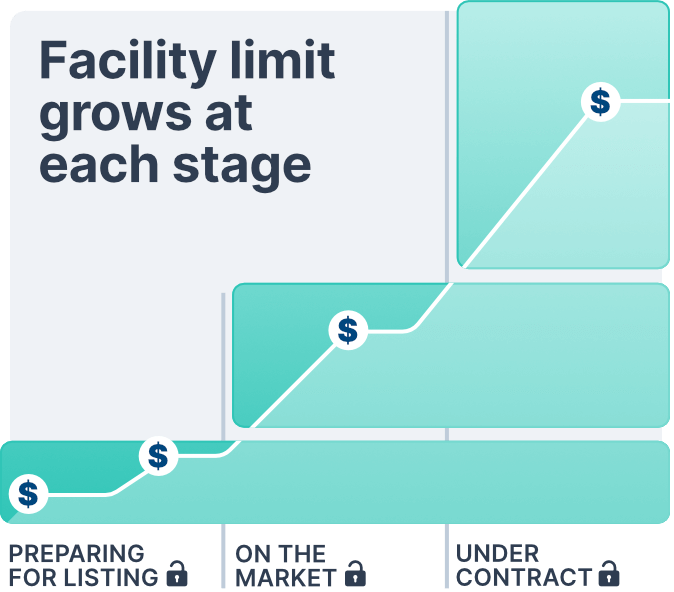

Every stage of the property sale journey presents another opportunity to access equity.

A Property Credit bridging loan can be offered at any stage of the property sale, right up until settlement. Once established, our flexible funding options allow you to access funds once-off or throughout the sale.

Initial stage: Find agent, prepare for sale

The owner applies for pre-sale improvement funding, establishing a line of credit or 'bridging facility' as part of the application. This line of credit allows for future drawdowns at various stages of the property sale if needed.

Marketing stage: Property on the market for sale

Once the property is ready for sale, the owner can apply for property advertising funding. Applying for additional funds from your bridging facility is a quick and straightforward process.

Contract stage: Property has a contract of sale

With a contract of sale on the property the seller can now access equity release funding while they await settlement.

Final stage

There's so much to consider when buying or selling. Below are just some of the opportunities equity release can offer over the course of a property sale.

You don't have to take our word for it; our customers and real estate partners have been raving about our funding solutions.

Property Credit were a godsend! They were very easy to deal with and helped take the stress away from repairs, clean ups and moving. Thank you Property Credit for providing a great service that we never knew we would need.

jkimi100Prompt service, good follow up, pleasant to deal with on the phone. All round a very high standard.

IanAll the people that I spoke to were very helpful, friendly and professional. Nothing was too hard for them. I would totally recommend Property Credit. They even rang me outside of office hours, five stars!

AnneMarie CainesVery professional team. Very friendly and efficient. A truely seamless process. I would highly recommend them.

Susan FitzsimmonsProperty credit is a great company to work with and offers a great solution for our clients. Terry is always on hand to assist and always goes above and beyond to assist our clients. Thoroughly recommend Property Credit.

John StilianosEverything from the process to apply and access money all the way until paying the amount off was easy and wonderful. I will definitely recommend you and your company. I just called my friend who referred me to you to thank her for recommending you as I will

Lehmann RightsEverything was very easy and hassle free. The funds came through extremely fast. Will definitely use them again.

Scott