We hear of savvy sellers using equity to further along the sale of their property. But what exactly is equity release and how can you use it to your advantage? Let’s unpack all things home equity so that you can get the most out of the sale of your home.

Home equity is the current market value of your home less the amount owing on your mortgage. Simply put, it’s the portion of your home you actually own. So if your home is worth say $800,000 and you have $300,000 owing on your mortgage, the equity would be $500,000. We call this your home’s ‘locked up’ value.

Many don’t realise that you can access equity to service a number of cash-flow requirements like,

…you name it!

We buy and sell for different reasons. Whether you’re upgrading, downsizing, or sea-changing — selling a home is one of life’s biggest undertakings.

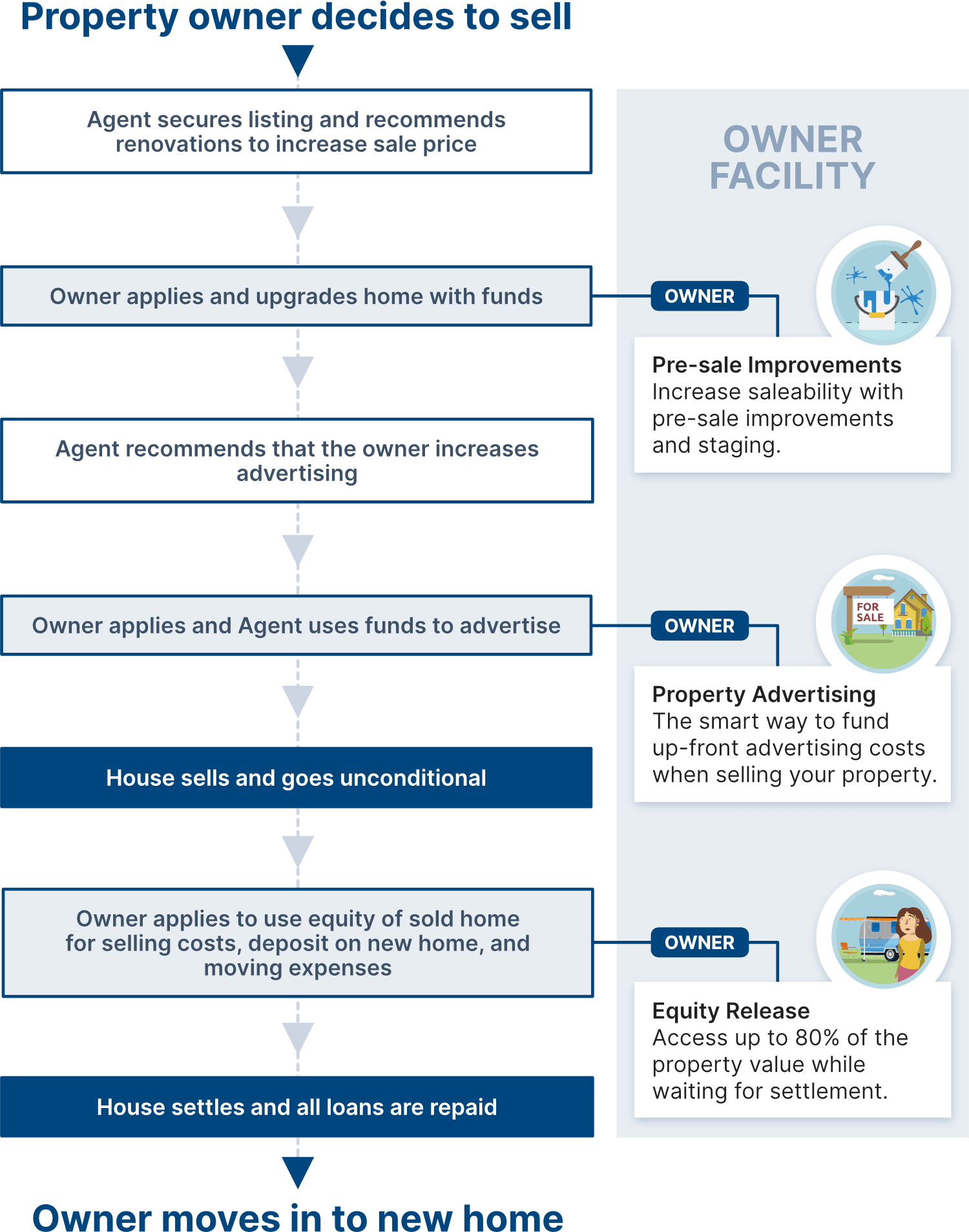

Property Credit offers funding at every stage of your property transaction to help streamline the process and take some of the guesswork out of the buy and sell timeline.

One of the biggest stresses on buyers and sellers is securing their next home before the settlement of their current one. But Property Credit allows you to start house hunting before you settle, easing some of that pressure to rush the sale of your home.

Equity release funding helps bridge the gap between what you plan to do after the sale of your existing property, and now. So it could be used to put a deposit on a new home, or any number of the cash-flow barriers we discussed earlier. If you’re wanting to bid at an upcoming auction but haven’t yet settled your current property, you can apply for an auction deposit again, using equity to buy with confidence.

A home deposit can be just the beginning of your journey with us. We offer funding at every stage of the property transaction to help streamline the process. So as your sale progresses, so too can your funding requirements. Much like having a financial safety net, Property Credit can adjust the size of your loan facility as it’s required.

So, if your agent recommends increasing the advertising of your property, we can help cover those upfront costs as well as any pre-sale improvements you might like to make to the home to increase saleability.

Visit property.credit for more information on our services or you can contact us on 1300 829 536 (au) or 03 668 2144 (nz).

This article is for general information purposes only and is not intended as financial product advice. Consider seeking independent financial advice that relates to your individual circumstances.

There's so much to consider when buying or selling. Below are just some of the opportunities equity release can offer over the course of a property sale.