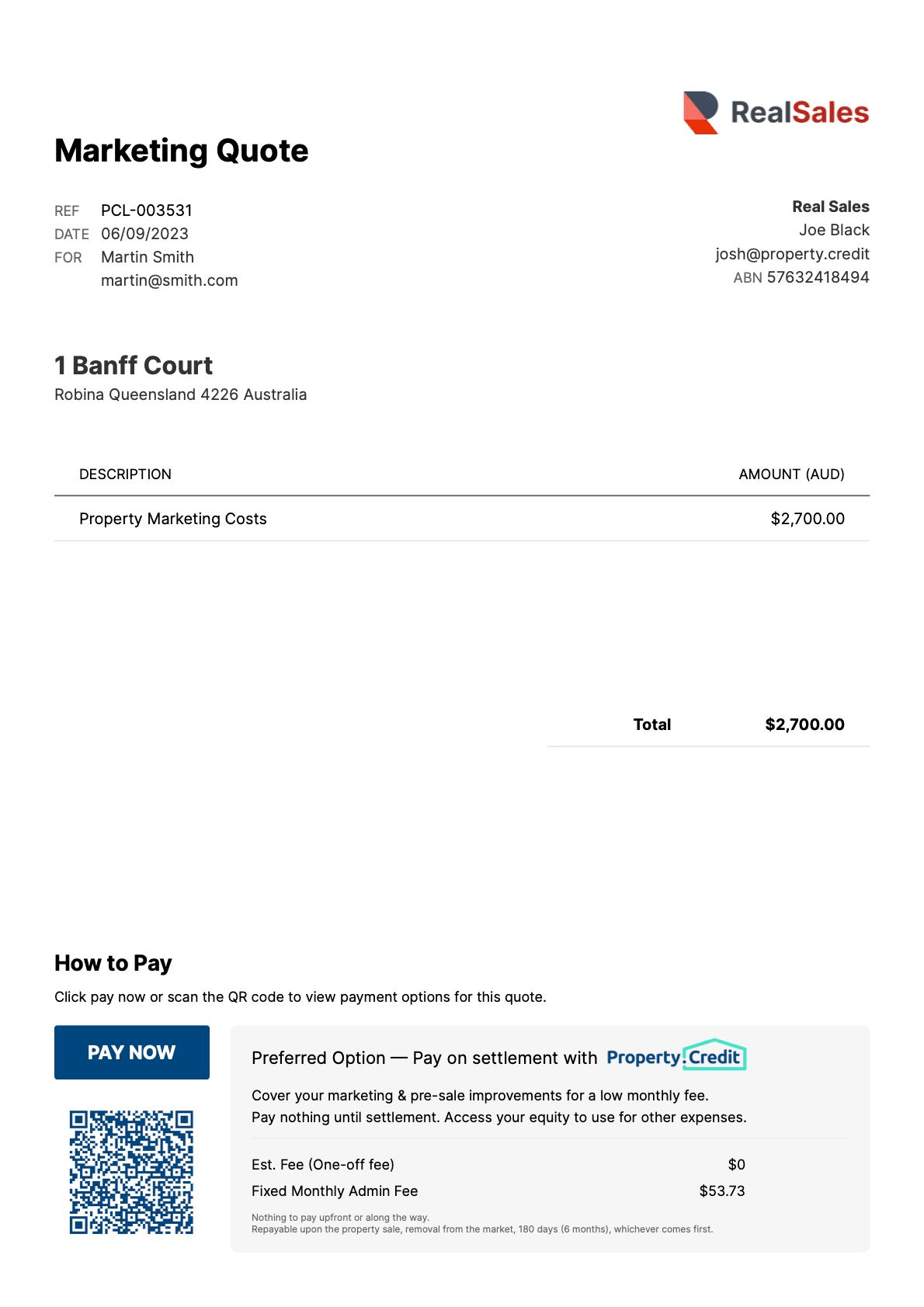

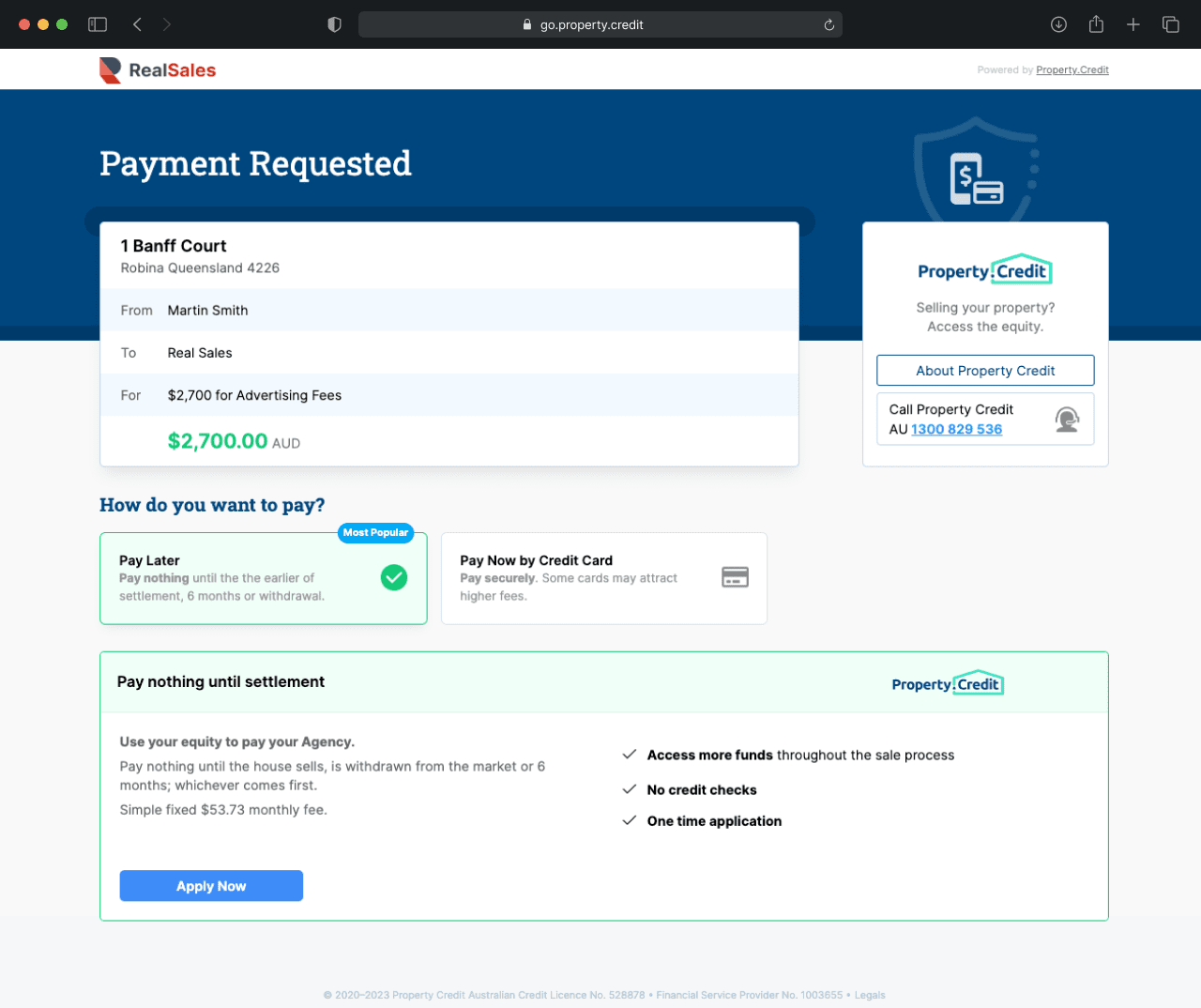

A Property Credit bridging facility lets your client access the equity in the property they're selling to help service any number of property transaction costs.

Secure more listings while adding value for your clients with a pay-later solution for property transactions. Spend less time having the 'who pays for what' conversation and get back to doing what you love—selling!

Simple referral form, we take care of the application.

Safeguard vendors changing agencies—their loan is linked to your business.

Clients can pay for selling costs via credit card with the funds deposited into your business account.

Property owners can unlock the equity in the property they are selling to cover selling costs or any number of cash-flow requirements. With nothing to pay upfront and no payments until settlement, we ease the financial stress of selling.

One-time application.

No credit checks.

Funds released in as little as 3 hours.

No maximum age limit.

Unlock equity for any number of cash-flow needs.

No payment until settlement.

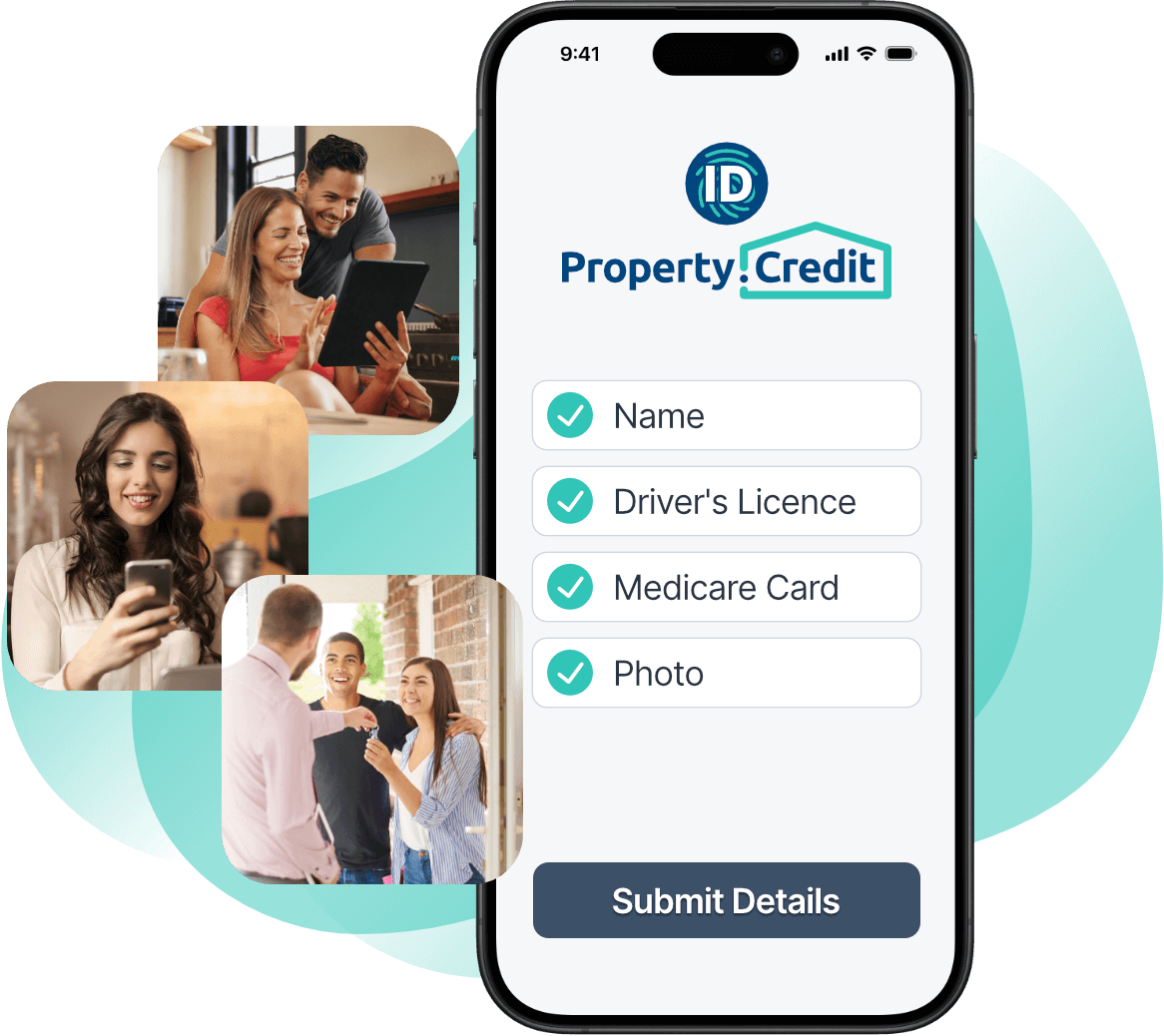

Vendors can easily verify themselves in a couple of minutes. Coming soon for real estate professionals within the Property Credit Portal.

Register for early access today.

Property credit is a great company to work with and offers a great solution for our clients. Terry is always on hand to assist and always goes above and beyond to assist our clients. Thoroughly recommend Property Credit.

John StilianosAlways a pleasure to deal with these lovely ladies! Very quick response and a hassle free process! I highly recommend.

JoJoI can't thank the team enough for the sensational job in facilitating a loan for my client. They really took the actual time one-on-one to understand my client's situation. Very professional from start to finish.

BJ GregorySimple referral process and super quick approval for the Client. Highly recommend these guys for any of your short term Real Estate lending needs.

Travis RaynerThe team at Property Credit are world class professionals. Every step of our journey together has been a pleasure and I could not imagine our business without them. They’ve made things easier for our team and our clients are thrilled with their service and excellence.

Jonathan KingIn my experience no request has ever been a problem for these Property Credit to deliver which is rare for funders. More so where they have met some very tight timelines which as an agent we know this is common.

Silvio BevacquaWe’ve found Property Credit’s quick and accurate response times helped not only our sales team secure listings and assist our clients cash flow, it really does fast track home preparation to maximise sale results in a very cost effective way.

Ross LukinProperty Credit hands down has the easiest system in place to provide credit for all of your real estate needs. If you are a real estate agent I highly recommend these guys. They are fast, effective and superior to any other platform.

Clint Jensen

Take the stress out of balancing bills with rental income and mediating between tenants and landlords with Investment Property Expense Funding. Any investment property expense, we can help.

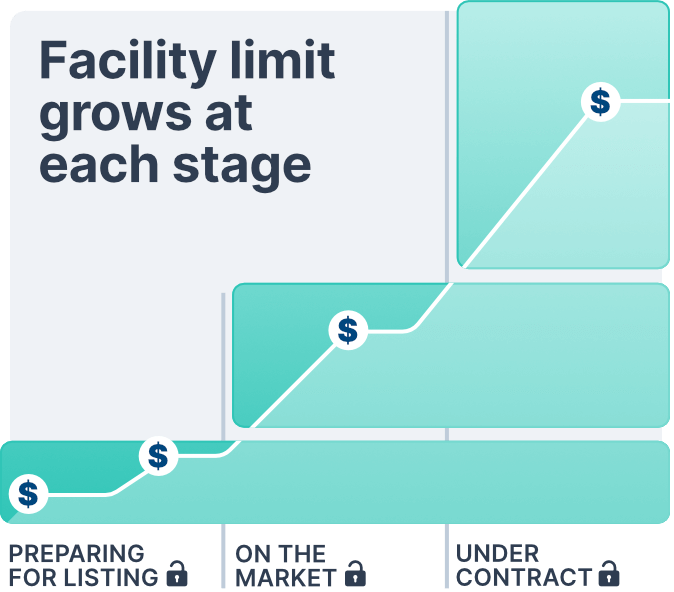

Below are just some of the opportunities equity release can offer your clients over the course of a property transaction.